INSIGHTS

Investor Relations:

Your 2021 Action Plan

Investor relations heads – many of whom will be feeling like they hung on by the skin of their teeth through a volatile, tricky and incredibly busy 2020 – might be breathing a sigh of relief as we head to the end of the year. But leaders in the field are using the closing weeks of a pandemic-ridden, crisis-driven year to regroup and put in place global best practices that will position IR as a critical function in 2021.

For IR directors, 2020 has built hard-won experience. But you can be sure that whatever your challenge – whether it’s raising capital, increasing trading volumes, expanding the share register, balancing transparency with disclosure rules – the spotlight will be on the function to an even greater degree in 2021. For some, an acceleration in the shift of global economic activity and wealth towards emerging markets will lead them to new investors, which will require them to flex their traditional approaches to communications. For others, continued market instability will demand an ever-more agile approach to disclosure. Amid all of this, there are secular trends that will continue unabated, especially a shift towards integrating ESG reporting with financials.

In November 2020, Andrews Partnership hosted a panel discussion with Christian Arnell, Head of Investor Relations at Diginex, and Ronald Low, Managing Director Hong Kong at Sard Verbinnen & Co. Together with a group of more than 50 senior IR leaders from around the Asia Pacific region, they shared their learnings from this volatile year, and offered some insights into the strategy and tactics they would be deploying in the coming 12 months. The group – representing IR heads at public companies and private equity firms – has adapted quickly not only to new technologies, but to vastly different market conditions. Amid all the difficulties, they’ve built their teams, supported and c-suite, raised capital and driven the function to new prominence. These are their insights.

THREE RULES FOR EFFECTIVE INVESTOR COMMUNICATIONS THAT YOU CAN APPLY TO ANY CRISIS

Our panel and attendees agreed that consistent messaging – always a key to successful IR – was all the more critical in a crisis. Ensuring the messaging to investors was consistent across all channels – meetings, calls, web sites and other digital resources – kept IR teams busy throughout 2020.

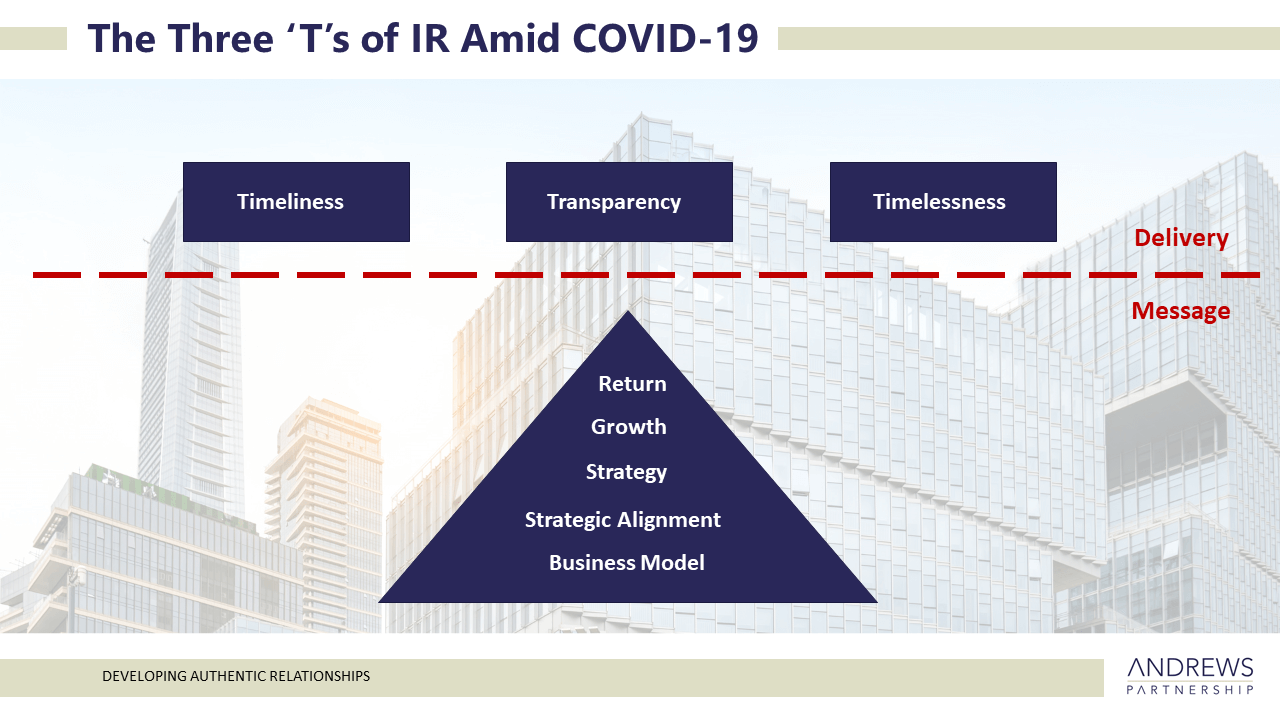

As communications professionals, we’re often focused on what we want to say to investors, rather than on what they want to hear from us. As much as we want to tell the story of the business, our investors need that story to be delivered within certain parameters. Elements such as business model; strategic alignment to investor priorities; corporate strategy; growth; and return on investment are all part of the message we need to get across, but that message can be lost if it doesn’t incorporate a delivery structured across three key areas:

Timeliness – in that your communications are timely in meeting the needs of investors. IR leaders said 2020 – a perfect storm of uncertain performance and volatile market conditions – was marked by investors “insatiable demand for updates”, which sometimes challenged both companies’ commercial agendas and disclosure timetables.

Transparency – by which we mean no surprises. You must be candid and realistic about both the opportunities and the risks in an environment that’s both opportunity- and risk-laden. Transparency also means close interaction with your businesses communications professionals, because the message to investors is inevitably impacted by what you’re saying to your other stakeholders, and especially your employees. Internal communications, government affairs, media relations and IR need to be messaging the same story. And that can be tricky when the situation is changing rapidly.

Timeless – in that you have a consistent narrative on strategy that allows you to demonstrate the company’s strengths and long-term value as an investment. And that all your communications – whether standard or crisis – are consistent with that narrative. If investors are committing their capital to your organisation, they need to know its long-term direction.

BEST PRACTICE LESSONS FROM 2020

Leveraging digital to its fullest extent

It’s a common complaint that investors are happy to agree to meeting on Zoom, but when the time comes to dial in, either they don’t show up at all, or they fail to engage, multitask, or drift off the call early. IR leaders were hugely challenged to not only get the right meetings, but ensure those meetings were valuable. Equally, digital also gave businesses access to a whole new set of investors.

Best practice: IR leaders are putting more effort into qualifying investors before a call, and seeking to better understand their strategy and interest. Shorter meetings ensure investors are more engaged, with some IR leaders adapting their pitch and presentation materials to suit, and are adding interactivity and data to their web sites to supplement meetings and calls. For those who relied heavily on physical meetings and tours pre-pandemic, there’s been a shift towards professionally-produced, pre-recorded content to supplement Zoom calls and provide additional value and insight to investors.

Keeping disclosures consistent

It’s not surprising that investors are keen to deep-dive into elements of the business in a way they may not have been tempted to do before, and some IR leaders are facing pressure to make more operational business heads available. There is a role for operations people in discussions with investors, but it’s up to IR to ensure they understand disclosure rules, and are only interacting with investors and analysts in a controlled environment.

Best practice: IR leaders need to know that any operations or commercial leaders who’re interacting with investors are properly briefed, and understand what they can and can’t disclose. Leaders in the field are using senior operations staff to amplify particular messages in carefully-managed meetings with investors, satisfying the demand for more in-depth information while enhancing key messaging.

Manage the audience

The media’s focus on some large and well-known brands has increased in the wake of the pandemic, and in many cases it’s fallen to IR teams to manage interest in the financial performance. While the media’s key contact will always be the media relations team, IR heads say they’re facing a dilemma: should they allow the media to attend or participate in analyst calls and meetings? Our panel shared some tactics for addressing this probl;em, but ultimately agreed investors and journalists are two very different audiences.

Best practice: Some IR teams are allowing journalists to dial in for earnings calls, but they’re ensuring that senior executives only take questions from analysts. For other investor events, it makes sense to restrict participation, given that some investors are reluctant to speak freely in front of the media.

Doing ESG well

While investors may have been preoccupied with the pandemic, the ESG reporting workload has only grown. IR heads have found more of this reporting is coming their way, particularly min organisations that haven’t designated a specific ESG lead. Managing this work on top of their existing responsibilities has proved challenging for many.

Best practice: While it’s possible to contract out ESG reporting, leaders in this space are taking on the challenge and using it to build a genuine commitment to a positive impact. Our panel advised IR leaders to draw on resources throughout their companies to ensure ESG becomes a way of doing business, rather than just a report.

Driving team performance when the share price isn’t where you want it to be

There are only a lucky few companies that would say their stock is performing well, with many coming to the end of a lacklustre and somewhat disappointing year. In a tough market, IR teams that rely on measures such as share price or liquidity as KPIs are disheartened and demotivated. The key to driving team performance is setting targets that the team know they can impact, rather than ones which they are unable to influence, or which will be too exposed to uncontrollable market conditions.

Best practice: SMART goals (Specific, Measurable, Achievable, Relevant and Time-bound) are one way of approaching this problem. Given that IR does not control company performance, share price in itself is not necessarily a SMART goal. An alternative adopted by some IR heads is to measure the impact of the message on investors, for example by cross-checking IR messaging against sell-side valuations and projections, or by conducting perception studies among investors and analysts.

HOW CAN I POSITION MY TEAM FOR SUCCESS IN 2021?

There are three pillars for successful investor communications in 2021, based on the learnings from 2020. They can be categorised broadly as talent, technology and trust.

On talent, find a balance in your team between analytic ability, strategic awareness and interpersonal and communication skills. Remember when putting together your talent plan that there’s no such thing as a perfect individual, only a perfect team. How each person interacts with others and builds the capabilities of your team is what you should be focused on.

Leverage technology not just during the pandemic, but as part of your forward strategy. Many IR teams had difficulty engaging investors on video conferencing technologies, finding it more difficult to get investor mindshare, more challenging to engage in serious investment conversations, and more difficult to assess how investment ideas were being received. The challenge for 2021 is to build engaging digital programs that will secure the right sort of attention from the right sort of investors.

Finally, trust. Your relationship with internal and external stakeholders – senior management, shareholders, analysts and other third parties, is hugely valuable. In the midst of the pandemic, IR teams have been working with expanded stakeholder bases, and engaging with a more global set of investors. The ability to build trust with individuals you’ve never met – and sustain it with those you haven’t seen for a long time – can be challenging. It’s more important than ever that businesses deliver on their guidance if the IR teams are to retain the credibility they need to work with investors into the future.

WHAT IR LEADERS FOUND CHALLENGING IN 2020

Communicating effectively with investors

- Making effective use of technology to access external stakeholders, and fine-tuning presentations to suit online.

- Fewer investor meetings, with investors pickier, less engaged and less committed to virtual meetings.

- Shorter meetings online than face-to-face: typically 30-45 minutes, rather than an hour.

- The introduction of virtual AGMs and EGMs has been fast-tracked, putting pressure on IR heads (but also driving innovation)

- No travel means IR heads are able to prioritise c-suite time based on investor, not geography.

- Harder to get time with investors outside of meetings, particularly in the US.

- Lack of face-to-face access to investors – difficult to build relationships and judge their response over video calls.

- Getting the right sort of investor interest. Our meetings increased two-fold, but many were just idea shopping.

- Brokers are marketing to client bases globally, resulting in cross country and cross regional participation. IR teams have had to adjust to this new trend.

Managing shifting expectations

- Making effective use of technology to access external stakeholders, and fine-tuning presentations to suit online.

- Fewer investor meetings, with investors pickier, less engaged and less committed to virtual meetings.

- Shorter meetings online than face-to-face: typically 30-45 minutes, rather than an hour.

- The introduction of virtual AGMs and EGMs has been fast-tracked, putting pressure on IR heads (but also driving innovation)

- No travel means IR heads are able to prioritise c-suite time based on investor, not geography.

- Harder to get time with investors outside of meetings, particularly in the US.

- Lack of face-to-face access to investors – difficult to build relationships and judge their response over video calls.

- Getting the right sort of investor interest. Our meetings increased two-fold, but many were just idea shopping.

- Brokers are marketing to client bases globally, resulting in cross country and cross regional participation. IR teams have had to adjust to this new trend.

Andrews Partnership are the reputation experts, with offices in Hong Kong and Singapore working across Asia, as the leading specialist corporate affairs, communications and investor relations executive search firm. We excel at understanding each organisation's unique challenges and appointing the right talent, who make meaningful business impact.